Is the Party Over for Real Estate Investing?

Real estate has been one of the best performing assets since President Obama took office.

No, we’re not talking about regular people’s homes. The biggest gains have come from so-called real estate investment trusts — REITs for short.

REITs are companies that own a lot of different properties. Some REITs specialize in just one type of real estate (think apartments in California) while others own a bunch of different kinds of property such as hospitals, office buildings and malls. They make their money much like any landlord does — by collecting rent.

Investors have gobbled up REITs since 2009 for three reasons:

1) REITs trade like stocks. REITs give you real estate exposure a lot easier than having to buy and sell actual buildings. It’s good for diversification, which is why sophisticated investors usually have about 5% or less of their portfolio in REITs.

2) REITs win big with an economic recovery. The financial crisis that triggered the Great Recession was caused largely by mortgages gone bad. That caused real estate prices to plunge. But when the economy started recovering, real estate (especially office space and urban apartments) bounced back. REITs benefited big time.

3) REITs have high dividends. Quite a few investors, especially retirees, like to have steady income from their investments. Normally they buy bonds to get that income, but the yields on bonds have been incredibly low — think 2% to 2.5% on U.S. government bonds. REITs, meanwhile, have been returning about 4% to 6% a year in dividends.

Investors have been substituting REITs in their portfolios for bonds. It’s been a shrewd move. People have received steady dividend payments while the underlying asset has risen in value nearly as much as stocks.

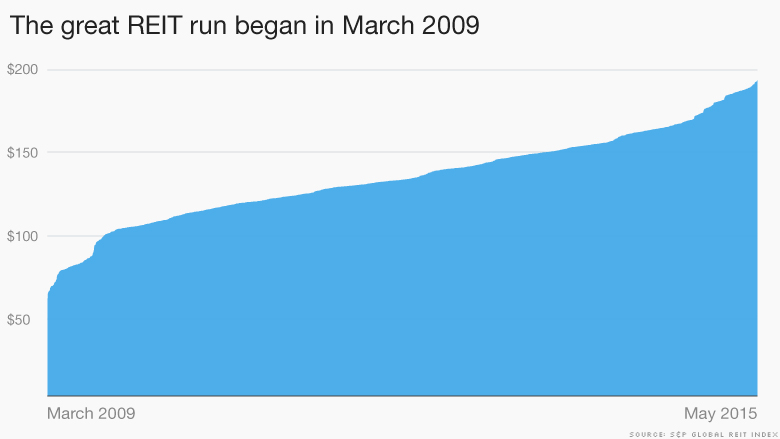

One look at the S&P Global REIT chart shows nearly 140% of returns since March of 2009.

Now there’s just one big problem: The Federal Reserve.

America’s central bank is signaling that it will raise interest rates, likely sometime later this year. As interest rates rise from their historic lows, so will bond yields. Suddenly investors who have been buying REITs in lieu of bonds are rethinking that decision.

REITs are typically seen as more risky than bonds since REITs have a lot of the characteristics as stocks.

Related: Fed: June rate hike is very unlikely

Prepare for the REIT market to get ugly for awhile. This year is already shaping up to be a tough one. Check out the S&P Global REIT return chart. It’s bounced all around and is currently flat — 0% return. Many of the biggest REITs — Simon Property Group (SPG), Ventas (VTR) and Health Care REIT (HCN) — are flat to down for the year.

If you look even closer, it’s evident that any time investors think the Fed is likely to raise interest rates, REIT prices fall. And then when investors think the Fed will hold off — until September or even later — on raising rates, REITs go back up.

The case for REITs: But before you write off REITs entirely, consider this: many top investment houses are advising clients to keep their REIT investments — and even add to them a bit.

Wells Fargo put out a report this week noting that “fundamentals for REITs and the underlying commercial real estate market are quite strong.”

State Street has gone a step further and said investors should have a modest overweight in REITs. Chief investment strategist Michael Arone sees growth potential in residential REITs now that more Americans have jobs and new home sales and housing starts are picking up.

Related: It’s getting more expensive to be a renter

Why keep REITs now? The reason is simple: The Fed will only raise rates when it believes the economy is thriving again. It’s a vote of confidence in America’s growth. As the economy improves, real estate typically does well too.

“The real estate cycle isn’t over,” says Scott Crowe, global portfolio manager of the Resource Real Estate Diversified Income Fund.

If you buy into the growth story, REITs should still benefit. Crowe is looking closely at opportunities in urban apartments and office space. He likes REITs such as Essex Property Trust (ESS) and Kilroy Realty Corp (KRC).